There are so many myths, misunderstandings and illiteracy when it comes to Profit and Loss Statements. One of the keys to consistent growth is understanding where you are financially every minute of the day. Sure, it’s good when you can pay your bills and take some money home and it’s bad when there is nothing left. But most us do not use the process of or the information in our P & L Statements correctly.

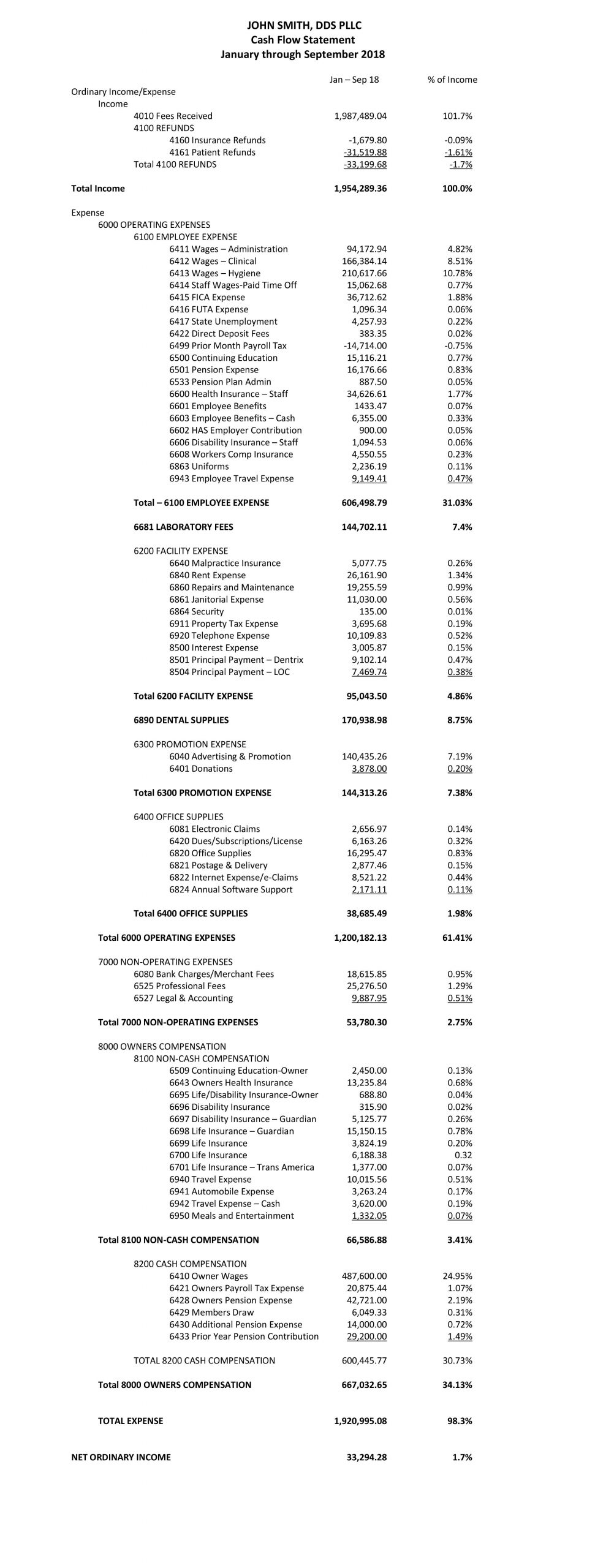

The title “Profit and Loss” would seem to imply that if you provided the correct numbers you could read left to right and go to the bottom of the page and see exactly what your profits are. This is almost always not the case. It leaves out one important, and for many, very large number that affects your spendable income. There is not a line item for the payments you make on debt to your bank or other lenders. The only thing that shows up on a P & L is a line item called “interest expense”. This is the interest on the loan payments but not the total payment. The items Depreciation and Amortization will also be listed, even though you can’t wipe your bottom with these. So, when you look at the bottom line or profit, remember that you need to subtract any business-related debt payments to actually see the real financial picture. Failing this, you assume you are taking home more money than you are. What you really want for operating your business and making day-to-day decisions is a Cash Flow Statement. Essentially this is record of everything that comes in and everything you spend.

For a lot of dental practices, the job of coding checks and populating a P & L statement goes to a bookkeeper, CPA, wife or staff member. Someone takes the bills and decides what category they should be added to on the line items of a P & L. This is the first step and often times it is done incorrectly. Especially if you want to use a P & L statement to manage the financial side of your practice. I have yet to read a P & L without finding errors in coding. So, what’s the big deal? Well, if you actually did use your P & L to make decisions and the expenses were not placed under the correct heading, there would be no way to take corrective actions based on the information you had in front of you. Someone who is versed in knowing where each vendor’s bills should be placed should be in charge of coding them. Most practices use QuickBooks which is good because at any moment in time you can just look at the software and check where you are. This is why it is important for you to have this software at the office or home, not just at the CPA’s office. You want to be able to follow your progress at least weekly to make sure you are on track. No one needs a CPA that sends you a Profit and Loss Statement 60-90 days after the month has closed. If you are making a mistake, you will be repeating it for an additional 2-3 months before you know about it. Remember: You are paying them to provide a service (and very likely overpaying at that). How can a 2-3 month delay in receiving the information be classified as “service”? You should be making decisions daily by consulting your QuickBooks software while there is still time in the month to affect the outcome.

The second point about a P & L Statement is that most have 50 or more items listed but because of different tax consequences for each item, they are rarely lumped together in one category. For example: Compensation for employees will usually have just the benefits, pay, and sometimes taxes in the category. For me, I want everything and anything I spend on the staff or any other employee I hire to work for or in my office. I would include staff meals, taxes, benefits, workman’s comp, pay, bonuses, continuing education, hiring costs, insurance, uniforms, payroll preparation, paid holidays and vacation, consultants, collection agencies, IT person, CPA, Attorney, and travel if it is for staff. If you take a look at your P & L you will find these cost of employee categories all over your P & L Statement. I want to know the nitty gritty of every major category and I will act when they are out of line.

I like to take your original P & L Statement and create 7 overriding categories that will contain all of the current line items you have but under each of these 7 categories.

Category Goal

1. Compensation 24% to 28% (if including CPA and Attorney)

2. Facility 7%-9%

3. Lab 8%-10%

4. Marketing 3%-5%

5. Office Supplies 2%

6. Dental Supplies 6%

7. Owner Doctor pay and expenses 40% MINIMUM

NOTE: Click here to download a copy of my book. Chapter 16 goes over in detail the make-up of each category.

Make sure as you go through your Profit and Loss Statement that you do not see a “Miscellaneous” category that is in fact a dumping site for personal expenses or your CPA’s attempt and failure of categorizing an expense properly. The second thing is a conversion to the format we are recommending that more closely resembles a Cash Flow Statement. You can see how the CPA for this practice was able to take his or her existing categories and group them together into our suggested categories. It’s really quite simple. You will notice that in addition to the seven categories that allow you to quickly monitor the numbers, you will find a total percentage included beside each one of them. It is that percentage that is important, not just the dollar amount. You will notice that none of the subcategories have changed. Everything is just cleaned up so that you can monitor and use this document to manage your practice in a timely fashion.

Please feel free to give us a call if you find a category that confounds or contradicts our categories. I am sure there will be a few. Making sure your numbers are clean, true, and instantly available is the sign of a fully engaged owner in a financially sound practice. This is how you Summit.

Michael Abernathy, DDS

972.523.4660 cell

[email protected]