We are moving on to the second and third pages of the Growth Analysis Spreadsheet as we define and understand this document on the journey to purchasing a profit centered new practice. This evaluation sheet can be down loaded by simply clicking this link.

In addition, make sure you have also downloaded The Super General Dental Practice at www.supergeneralpractice.com and read chapters 16 and 17 on benchmarks and overhead.

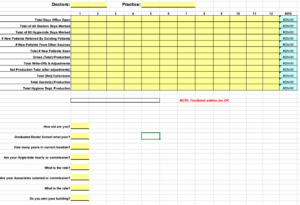

Last week we discussed the benchmarks and first page of our spreadsheet. We begin next to turn to pages 2 and 3.

As you can see, this portion of the spread sheet is all about quantifying what is coming into the office whereas a Profit & Loss Statement would detail what was spent or going out of the office. On page two of this Growth Analysis Spreadsheet, we are looking for the data for the last 12 months. Before we start, I want to make sure that we cover a couple of points before discussing the financial details. We are looking at the last 12 months because from our perspective of profit and transferable value, twelve to thirteen months will define what we are willing to pay for a practice. On the other hand, your friendly broker will normally want to average the last three years if it means that you will be paying more for the practice and it will increase their commission on the sale. As far as we are concerned, we don’t care what they did in the good old days. If a patient hasn’t been in for a hygiene visit in the last 13 months, they are no longer an active patient that I am willing to pay for. Focus on the now, and other than assuring that the practice is stable, we only care about the last twelve months.

This second page of the spreadsheet will take a front desk person about 30-60 minutes to fill in. If it takes longer than that, it indicates that the doctor and/or the staff don’t understand their way around their practice software. It helps us see how much the doctor(s) work, and how long or how many days the hygienist(s) works. Ideally, a really good practice will have twice the number of hygiene hours as doctor’s hours. The next few line items delve into new patients. Where did they come from? It is important to differentiate between direct referrals from existing patient’s vs patients that come in from being in network for their insurance or some other marketing that would show up as marketing dollars spent on their P & L Statement. Great practices will always have at least 50% (minimally) of their new patients coming from direct referrals. Since it is commonplace to not see this, a lack of new patients from direct referrals should be a red flag indicating that there are going to be challenges in the protocols, staffing, systems, and leadership of the practice.

The rest of the line items pertain to net adjusted production, write-offs (adjustments from insurance, in-office discounts, etc.). These six line items will tell us the doctor’s production, hygiene production, and whether or not they have a good collections percentage.

At the bottom of the page, we will see seven questions that further define and clarify income and facts about the practice. We need to know the age of the doctor in order to understand if age might have something to do with the sale. Time at this location might indicate that 20 years ago, it was a much better location, and now the demographics may not support future growth if we purchase the practice. If the time in this location is very short and they want to sell, this might indicate that it is a poor location, untenable landlord, or they have just outgrown the location. Every number has a ripple affect and we will be coming back to these numbers as we get closer to a purchase.

How are hygienists paid? Hourly, commission, hybrid pay all create an image of what we will inherit if we purchase this practice. None would necessarily cause you to walk away, but each hint at challenges if you want to retain this employee in your practice. This same can be said if there is an associate: What is the pay and how are they paid? Do the numbers work for profitability and consistent quick growth?

The third and last page of this Growth Analysis Spreadsheet automatically takes the data from the first two pages and collates, organizes, and summarizes benchmarks and summarizes them in a percentage or dollar amount. I will take a moment and give you the ideal benchmarks for each category and a bit of insight into what they mean. We will revisit each of these categories in a discussion and link to an online recording of a real office with real numbers and implications for an actual practice that is for sale at a later date.

Collection Ratios: Certainly, we are looking for a 100% plus collection rate, but this is rare to find. Always consider what 1% of a practice represents. In a million dollar a year practice, 1% = $10,000. One percent here and there can destroy profitability. Also, if we see up and down collection numbers, this could indicate embezzlement, poor financial arrangements, poor follow up on collections, insurance, and poor patient retention and recall.

Production per new patient: NOTE: This is not production on each new patient, but just production per new patient. For example, if you collected $60,000 in a month with 30 new patients, then your production per new patient was $2,000. In the world of average practices, this number would be about $1,400 or less. In a great practice, it would be $2,500 to $3,500. In a low patient volume boutique practice it could exceed over $5,000. Low production per new patient can indicate poor case acceptance, low case presentation numbers, non-assertive doctor(s), poor financial protocols, etc. Every number we have summarized on page three indicates positives and negatives in a purchase, along with trends in performance and results.

Production per day office is open: Pretty straight forward but we need to see consistency and not up and down numbers. This points to the type of practice that we are looking at from a profitability stand point.

Production per Op: We discussed this on page one, but as a reminder the goal would be in the $25,000 to $30,000 per month per op. The national average is a little under $14,000 per month per op. Again, this will surely point to profitability of the office that will be confirmed when we look at the Profit and Loss Statement data.

Production per employee: Whenever I mention “production”, I am indicating Net Adjusted Production – not gross production. This would be production adjusted for write-offs, discounts, etc. We discussed this when going over page one, but ideal would be $20,000 to $25,000 per employee per month. Miss this and your profit crashes. Most offices that are average only do about $13,000 or less per employee. But from a profitability perspective, none of us want “average” results in our own practices. In purchasing a practice, I will argue that perfect is not what we are looking for. There are few doctors, who, if they purchase a practice hitting each and every one of our ideal benchmarks, could actually maintain this. You would pay top dollar, and the value would not be transferrable to the average doctor. You would be destined to see this ideal practice devolve into something less than what you paid for it. We will revisit this philosophy of looking for the upside of an average or less than average practice that has multiple areas that you could improve. This upside possibility means multiples of profit that even an average dentist could take advantage of. Making sure a purchase works for an average dentist ensures that there is a hedge or safe harbor for most dentists. It is a cushion of safety that creates the potential for more profit for just about any level of dentist.

Production of all doctor and production for all hygiene per days the office is open details the ration of doctor to hygiene percentages. Ideally it should be 33% of collection/production should come out of hygiene. We are looking for any inequity or deviation from that ideal benchmark. We want to become that educated consumer in buying dental practices that we are shooting for.

Hygiene production per hygienist per day worked: In great practices I see this net adjusted production in the $1,200 to $1,500 range. Certainly, this is rare because few doctors run their practice as a business, but it is still possible to hit these benchmarks. Based on the rise of demands from hygienists to be paid $50 per hour or more, without an increase in production and net profit, these demands will not survive the office’s ability to pay them. Hygienists should be paid the way associates are paid. Going rate for an associate is an average of about 30% of their net adjusted production or collections plus any benefits offered. This aberration due to COVID along with a 35% exit from the job market of hygienists since 2020, has created a challenge in our hygiene departments. If this does not correct quickly, we will see an increase in associate hires, doctors doing their own hygiene, as well as expanded functions in every state to allow assistants to perform many previously done hygiene services. This trend will not stand the economics of our businesses.

Hygiene department percentage of practice total: The ideal would be 33%. Remember what 1% of a practice is actually worth. In our example of a $1,000,000/year practice, 1% was $10,000. If hygiene only brought in 25% or 8% less than the ideal, that would be an $80,000/year shortfall in collections and profitability. This could be laid at the feet of too few new patients (there needs to be at least 20-30 new patients for each full-time hygienist per month), lack of diagnosis and treatment of periodontal disease (there should be at least 20% of the new patients treated for perio), lack of scheduling expertise (no one needs exactly one hour to have their teeth cleaned – every patient is unique). They might need 50 minutes, 45, or even 20-30 for a child, but statistically hygienists demand 1 hour for a recall), lack of using technology and staff to help the hygiene process to be more efficient (use of Florida probe, assistants, delegation, etc.). It could even signal a lack of dedicated money and time towards attracting new patients. Competition in your demographic caused by a ratio of less than one dentist to about 2,000 potential clients can doom a practice to mediocrity. Each of these are to be avoided in the purchase of a profit motivated acquisition with rapid growth through upside additions.

Next time we will discuss reading and organizing the Profit and Loss Statement to actually understand the current overhead as well as what factors impact these percentages and numbers. This will allow you to analyze the historical perspective of the practice outflow of money.

Michael Abernathy DDS

972.523.4660 cell

[email protected]