Way back 5 articles ago, I started this series of blogs based on this question from a doctor: How do a create a budget? Honestly, this is a sort of “What came first, the chicken or the egg?” kind of question. Success in your practice would have to include understanding each component of this can’t miss profitability equation:

PV x PEV x CP – O = P

Patient Visits times Production per Each Visit times Collection Percentage minus Overhead equals Profit. A formula so simple, yet profound, in its fundamental truth of running a dental practice. The danger with something like this is that it is so common sense that many will assume they already know this information. Information that forms the foundation for profit in your practice. Take it from me, if you are not growing 15%-20% per year, you skipped becoming a master at some of the basics of the business of dentistry.

I rarely get questions about budgets until a doctor is in practice and they have a month where there was more month than money left. This is usually punctuated by maxed out credit cards, inability to have any flexibility in spending, and living about 10% higher than their take home. Desperation is a mean mistress when it comes to stress and financial struggles. So, let’s talk about budgets. I will assume that each of you have your free copy of The Super General Dental Practice (www.supergeneralpractice.com), you have read chapters 16 and 17 on benchmarks and overhead, you have also read the preceding articles (you can go to www.summitpracticesolutions.com/blog and find them in our archives), and have by now self-diagnosed yourselves with the Income and Expense Summary we supplied in the previous article. With all of this preparation you should have a solid notion of exactly where you are and where you need to focus. Budgets keep you on the playing field. They denote the sidelines and goal line. You will find yourself constantly stopped in the red zone and never really scoring without a vision and goal called your budget.

I have already done the work for you on tracking the most important numbers on your way to profitability and a budget. The ideal goal numbers were listed on the right side of the Income & Expense Summary so that all you need to do is fill in the blanks, compare it to the ideal, and act on the areas where you fall short. It is the summary sheet for income and expenses that details the default budget that is already created by your current results. You can’t begin to formulate a budget for the future without knowing exactly where you are now. There is no short cut to this.

We also supplied a goal sheet for planning, or in this case setting up a goal for your budget. Make sure that each team member sees and understands the business side of the practice by sharing the summary sheet and explaining the numbers. Then, as a team, set up a goal for next month and each month for the entire rest of the year. Discuss and discover exactly where your practice is so that each team member has a clear, concise view of the business side of your practice. Involving everyone creates this ownership mentality that every practice culture needs. Partner with your team.

I want to direct you back to the Super General Dental Practice and Chapter 28 titled “Money”. This will give you a detailed step by step approach to profits, strategies, and systems that you can immediately adapt everything to your practice. One of the worst things you can do is to put off acting on the data you have right in front of you. Procrastination has ruined many a doctor’s future success. It is like failure to launch because you can’t decide to start. Too many of you think that you need 100% of your questions answered before you can make a decision. In this case there were no gray areas. This is the brilliance of dumbing down the business of dentistry into an easily understood system that guarantees your success while further educating you and your team. Don’t wait, get this done now. I know you are ready. Just take the first step.

Having outlived many of my contemporaries, and having looked at thousands of practices and their numbers, I am saddened when I consider how poorly dentists have handled the millions of dollars that have slipped through their fingertips during a career of dentistry. Psychologically, it seems almost impossible that every dentist shouldn’t retire from dentistry financially secure. Yet, that is not the statistic. Only about 5%-6% of dentists retire financially secure. This financial independence could be defined as having the income after you retire at the same level or greater than you had while working. Having the money and time and health to enjoy it is the epitome of financial freedom. This elusive goal escapes the majority of dentists because of a couple of things that form their actions and opinions of money. I would like to briefly describe these areas and leave you with a plan for unlimited wealth and an attitude of joy knowing that you actually won the game of life.

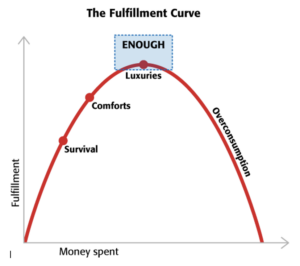

Decades ago, I read a book called Your Money or Your Life by Joe Dominguez and Vicki Robin, where they introduced something called the Fulfillment Curve. This fulfillment curve explains the relationship between money and happiness. I would argue that it gives you the ultimate answer to the question: How much is enough? Let me explain.

Below is an image of the fulfilment curve. The X and Y axis are money spent and fulfillment from that purchase. In addition, we have a simple bell curve. On the left side of the curve, you will find the words survival, comforts, and luxuries. Kind of shorthand for groups of “things” we spend money on.

Survival purchases are the necesities: Paying school debt, putting a roof over your head, food on the table, cloths on your back, and modest transportation. You get the idea. This category rarely gets abused. You are basically spending money on things that keep you alive and allow you to grow. As we move to comforts, and especially in the US, we begin to expand our desires and satiate the influence of “keeping up with the Jones’s”. Not horrible, but as we begin to use credit cards, lease cars, puchase homes that will take 30 years to pay off, and while we may have an emergency fund in the bank, we tend to slip on our long term savings, as vacations, fine Corinthian leather in our cars and homes lulls us into a state of “I have plenty of time to save” after all, I’m a dentist, I deserve to have a few nice things. As this point of entitlement, it seems that even the spouse is feeling the alure of the benefits of “wealth” or at least what banks will loan you. One step further and we begin to buy luxeries. These are the toys and trinkets of the idle rich where we own a car but we need to own the best car or two or three. Seems that this slips over to homes, boats, and cruises. There is absolutely nothing wrong with this. But are you still getting the same fulfillment when you spend? Is the joy of affluence being negated by the stress of tight budgets and living just a little above what you can afford? But surely there will be time enough to save for that retirement. Afterall, you are young and everything is going so well. Yep, it’s starting to sound like the introduction of The Twilight Zone by Rod Serling in 1964: “You’re traveling through another dimension, a dimension not only of sight and sound but of mind. A journey into a wondrous land whose boundaries are that of imagination. That’s the signpost up ahead – your next stop, The Twilight Zone.” Or, if you’re a dentist ready to retire and you find out that there isn’t enough money, you hate doing dentistry, but you wasted too many years, postponed too many goals, and now you find yourself searching for a way out, you will have entered dental prugatory. You are going to die with a denture repair in you hand. Jokingly, I can say without a doubt that by age sixty five most dentists are either dead or dead broke.

Basically you are ariving at the corner of Needs and Wants. This is the point where fulfillment is not what it used to be and it takes more and more to give you the thrill of the purchase. Sounds sort of like an addiction. Like it or not, a majority of dentists turn onto Wants Blvd. and never look back. At this point you are buying the best there is. You acquire it, learn it, operate it, store it, maintain it, insure it, fix it, make payments on it, protect it, keep it in “like new” shape, feel guilty about it, upgrade it, and sell it. I’m just saying, I’ve been there, I know what the sympoms look like and what your prognosis is. There has to be a time when you wake up and realize your trajectory and momentum are carrying you into a financial spot where you will have to work till you die.

For the outlier, this is where you begin to figure things out. You ask yourself: How much is enough? Keep in mind that as the fulfillment diminishes and the curve begins its descent on the right side, the end point is death. It all comes down to realizing the insanity of “profits, spending, and fulfilment”. Here is the inside secret of what enough actually means. It is when you have:

- Purpose

- Responsibility

- Accountability

- An internal yardstick

- Financial independence

You can tell you are there when you have peace of mind, you are out of debt, plenty of savings generating additional income, skills, and community. It is at this point that you will find clarity in finance and in your life. You will never actually arrive at perfection, but you will far outdistance 95% of the dental pack. Remember, as dentists we are blessed in that we can have anything in life we want. We just can’t have everything we want. Be wise in what you select.

I am sorry about how long this is. But when you write things down, take a stand, try to help others and don’t expect anything in return, there comes a point where you actually “need” to tell your audience the entire truth. I have said this before but it is worth repeating: People that tell you what you want to hear are trying to sell you something. People that tell you what you need to hear are trying to help you. The final point I want to make is via a score card for winning with money. I call this Life Success DNA for what to do with your profits.

- Income: Grow it. Income allows you not only to have more options and opportunities in life, but it also ensures your ability to adapt to an ever changing economy. While each of you deserve a comfortable life, you each will be given the opportunity to pass on your success by helping others. It is impossible in todays dental arena to ensure your future without a plan B. Income allows you to invest, and investments create opportunities for additional income. Just remember that every business is ultimately sold. You goal is to create another source of income that allows you to replace trading time at the chair for money. Your income must consistently grow about 15% plus every year or inflation and life suck (life style of the out or control dentist), or you will be slowly losing ground. To have this consistent growth you must stay engaged in the business side of your practice and investments. There will be plenty of time to coast when you are dead.

- Consumption: Control it. We are back to that Fulfilment Curve and deciding how much is enough. Becoming addicted to the next shiny object will always lead to disappointment. It pushes you to live above your income, betting on future earnings to feed your instant gratification today. This is a horrible financial loop that, for some, is insatiable. We have had clients borrow money to buy luxury cars to motivate them to work harder. That’s pretty sick. Learn to live at least 20% below your income.

- Debt: Eliminate it. There is a time that each of us needed to borrow in order to go to school, or start that first practice, or buy that first home. The error here is thinking that debt is normal and you just have to borrow to get things done. Nothing could be further from the truth, and this is a lie perpetrated by the little voice in the back of your conciousness telling you that “you deserve these things”. Make sure you read that chapter called Money. It clearly goes through the details of how you can eventually live debt free, consistently increase your profit, and how to create passive income. Interest on what you borrow is the “tax” on future income. This is a terrible habit that most dentists get into. I still see doctors 20 years after dental school having not paid off their school debt. I have seen doctors with over $100,000 in consumer revolving credit card debt while only paying the minimum payment (it will take over 42 years to pay this off). This is crazy. Reel in your appitite and learn to live far below your means.

- Savings: Build it up. Compound interest: The eigth wonder of the world. This is a lesson that far too many never heard or purposly turned their back on the reality of needing to increase their savings. Don’t spend the money, save it, invest it, get a return on investment, save that, and reinvest while constantly observing and adapting to the financial risks of where you might place your money. Life happens. Man plans and God laughs. Each of us will face problems in our lives where, without having saved, we will find ourselves in an untenable position. Becoming the person that saves and invests means being able to face almost any financial challenge in the future. The biggest lie I hear is telling young doctors that there is plenty of time to save money later in your career. Start today and rewrite your future. The best vision of the future is a profitble practice, consistent growth and profits, a deep savings program, and the abilility to enjoy your labors. The sale of your practice is not a destination. It’s sale will in no way leave you with enough money to retire. Being financially independent, while awesome, will not make you happy. Security is a great anchor for a happy life. just chasing more money is not. Lose those excuses for why you don’t do these things and start stacking up those great results. By your late forties you should easily have saved one to two million dollars and invested that in producing passive income that is also reinvested. By fifty-five you should have another one or two million. By sixty you should be in the range of 4-5 million with the opportunity to sell or continue to work. Keep in mind that in the last twenty years the average retirement age of a dentist has gone from 62 to 71 years of age and is still climbing because most doctors fail to see their future clearly. By your sixties, it will be obvious that the past has limited your future options and that you will never be able to support the lifestyle in the future based on borrowing money. Young doctors in your first 3 years should be able to save a thousand dollars per year of age. If you are thirty, save thirty thousand dollars that year. After the first 2-5 years, you should be putting away about 20% of your income every year. This has to happen every week and every month. Remember that in addition to your savings, you are on task to pay off all of your school debt in the first 5-10 years after graduation Don’t wait until the end of the year and then try to save something. Save first, then live on the rest, not the opposite.

- Giving: Increase it. There is no greater joy than putting yourself in a position to give to others. That could be money or what money could buy. It could be your time, your mentorship, your expertise to someone struggling. It is surprising at how embracing the steps and acting on the first 4 topics of this list will transform and create the type of person who feels they need to help others. Become that person. I did not make this up and I don’t even remember where I first saw this but “it’s not what we gather, but what you scatter that tells what kind of life you have lived.” Not a bad motto and attitude to live by.

There you go, a list of what to do with those profits. Create a budget to ensure that each day embraces the truths of this discussion. Become the person that not only follows this advice, but models its power to others.

Michael Abernathy DDS

[email protected]

972.523.4660 cell